This November, we’re reflecting on what it means to be a business owner, and there’s…

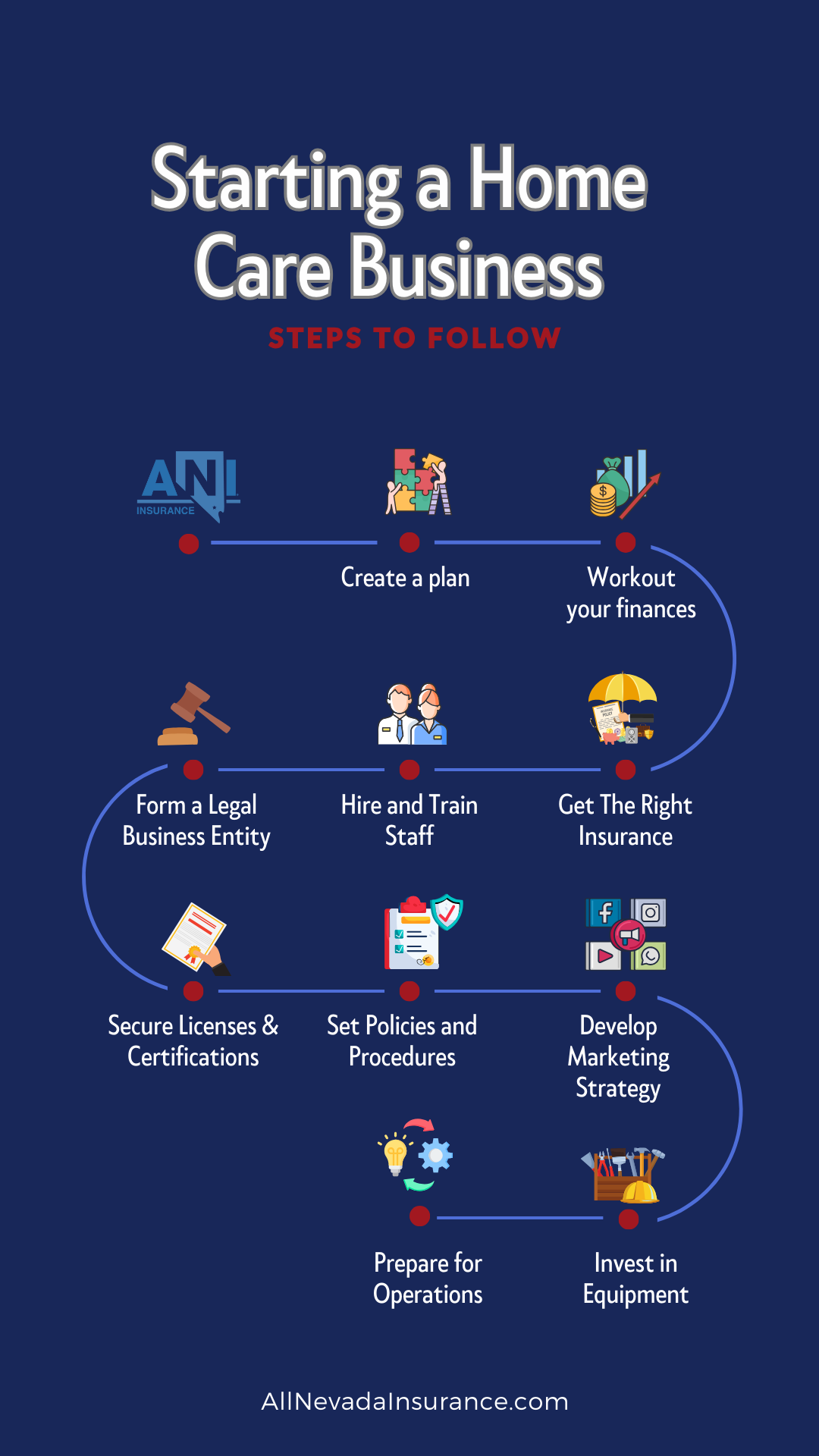

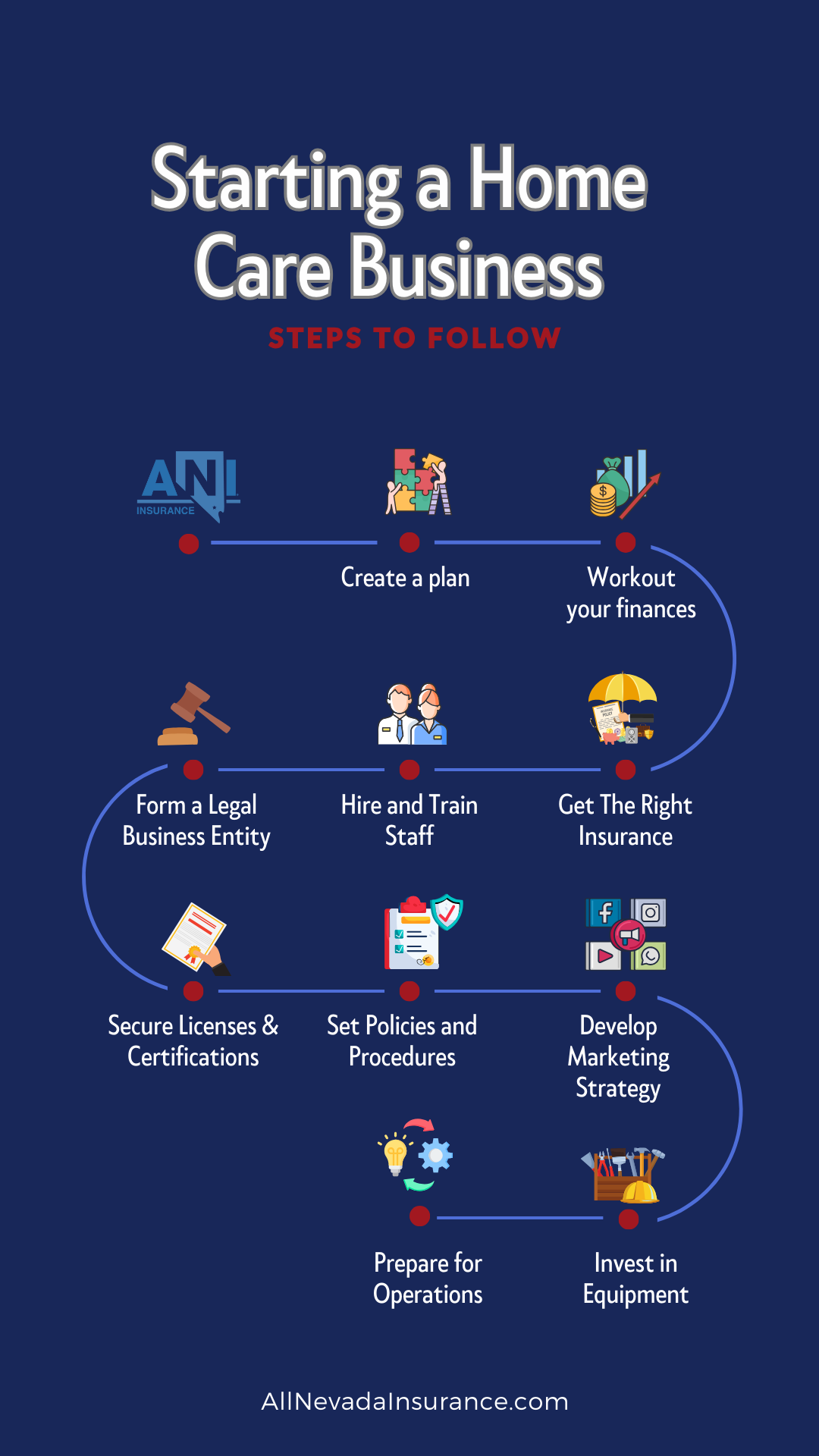

Looking to start a home care business?

Starting a home care business is like creating a sourdough starter. It takes plenty of patience, the right ingredients and a tried-and-true formula. Here’s a basic roadmap to help you embark on your home care business journey.

Our focus as an insurance broker is to help you with Step #5. At All Nevada Insurance we have over 100+ carriers to shop with. Especially when it comes to covering your businesses. Like in baseball, stay on the ball by keeping your bases covered. Protect your business and employees from unforeseen circumstances with general and professional liability insurance.

Our focus as an insurance broker is to help you with Step #5. At All Nevada Insurance we have over 100+ carriers to shop with. Especially when it comes to covering your businesses. Like in baseball, stay on the ball by keeping your bases covered. Protect your business and employees from unforeseen circumstances with general and professional liability insurance.

What does general liability (aka small business liability, commercial liability) insurance cover for my business?

As a business owner, you may be responsible if another person gets hurt or if their property is damaged while at your business or because of something you did. If you interact with clients face to face; use third-party locations for business related activities, have access to customer’s property, use advertising or marketing for your business or even require coverage in order to be considered for a project then you will need general liability coverage.

If someone comes to your place of business and is injured, a general liability policy could cover their medical costs. If someone else’s property is damaged and you are found to be responsible, the repair or replacement cost could be covered. And if someone’s reputation is damaged by something you or an employee said or wrote about them, the associated costs could be covered.

Do you plan on having an employee or employees? You need workers comp insurance whether they are part-time or full time. This is a cost paid by the employer when there are one or more employees. Unlike health insurance, the cost of work comp is not shared between the employer and employee. In the event an employee has a work-related accident, illness or death, the employer would likely be required under their state law to cover the employee’s medical costs and lost wages.

- Here is an example of a work comp claim:

A data analyst spends most of their workday using their computer. They begin to notice discomfort in both wrists, which turns to pain as the day goes on. Their doctor diagnoses carpal tunnel syndrome, and recommends surgery. The cost of the surgery is covered by workers comp insurance, as is a portion of the employee’s wages while they are out of work to recover.

These two above are just the start of the proper insurance coverage that you may need when starting your own business. At All Nevada Insurance we have the opportunity to help our community by explaining the different types of coverages that are needed to help protect our business owners from risk.

As we continue to grow out team we constantly strive to look for the person that wants to make a difference in people’s lives; want meaning in their life, not just looking for work; an entrepreneurial spirit; someone that wants to take control of their own destination with time and finances. For more information about how you can become a franchise owner with ANI, please go to www.anifranchise.com.